Oracle Cloud Human Capital Management Named a Leader 2020

- In evaluating Oracle’s HCM suite, the Forrester report notes, “Oracle Cloud HCM proves that long-term strategies and leadership pay off.”

- “Following more than a decade of sustained development, which included major investments in user experience design and the acquisition of Taleo (2012), Oracle Cloud HCM now provides a comprehensive, sophisticated HCM suite.”

- “Oracle Cloud HCM is a good option for larger, multinational organizations (more than 5,000 employees) with more sophisticated HCM needs.”

-The Forrester Wave™: Cloud Human Capital Management Suites, Q2 2020

“Our commitment to deliver purposeful products, meet evolving customer needs, and lead with innovation is indeed moving the needle. The report has recognized Oracle as a Leader in Cloud HCM.”

-Chris Leone, SVP of Applications Development, Oracle Cloud HCM

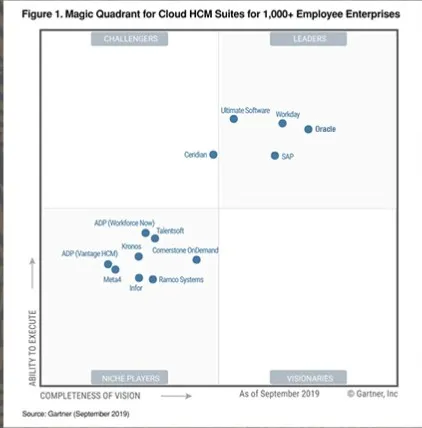

The 11 Providers That Matter Most And How They Stack Up

Why Read This Report

In our 30-criterion evaluation of cloud human capital management (HCM) suite providers, we identified the 11 most significant ones — ADP; Ceridian; Kronos; Meta4, A Cegid Company; Oracle Cloud HCM; Ramco Systems; SAP SuccessFactors; Talentia Software; Ultimate Software; Unit4; and Workday — and researched, analyzed, and scored them. This report shows how each provider measures up and helps CIOs and chief HR officers (CHROs) select the right one for their needs.

Key Takeaways

Workday, Oracle Cloud HCM, Ultimate, And SAP SuccessFactors Lead The Pack

Forrester’s research uncovered a market in which Workday, Oracle Cloud HCM, Ultimate, and SAP SuccessFactors are Leaders; Ceridian, Kronos, Ramco, Unit4, and ADP are Strong Performers; and Talentia and Meta4 are Contenders.

AI-Led Innovation, Value, And Functional Maturity Are Key Differentiators

AI is the new UI and will serve to not only simplify software usability but help improve workforce adaptivity through skills-based training and hiring. Vendors that apply AI with a skills-based approach, provide excellent customer service, and continue to scale their functional cloud maturity in key areas such as payroll, talent acquisition, and learning will continue to lead.

LEADERS BALANCE AI-LED INNOVATION, VALUE, AND FUNCTIONAL MATURITY

Cloud HCM suite vendors are attempting to do more than ever. In addition to supporting and fulfilling workforce operations and the employment contract (i.e., payroll and workforce management), they aim to aid the organization’s business and workforce strategy with tools that help attract, develop, and retain talent. Many vendors also have tools for workforce analytics, workforce planning, and HR service delivery as well as capabilities that support “total rewards.” (see endnote 1) Further, HR and HCM suite vendors serve many interests in an organization beyond designing for the employee experience, although that’s an important trend today. Heads of HR, CIOs, and CFOs — and their HCM suites — need to also support leadership, management, and shareholders. The outbreak of COVID-19 created a global health pandemic with massive economic fallout this year. It also delivered a stark reminder of the importance of HCM capabilities serving multiple constituents in an organization as HR pros, CIOs, and business leaders worked to ensure immediate workforce safety, resilience, and business recovery.This scale of capabilities (and their cloud maturity), combined with ever-changing external market and internal workforce dynamics (as evidenced by COVID-19), creates a “cauldron of complexity” for HR, technology professionals, and organizational leaders. As a result, most organizations remain dissatisfied with their HCM solutions and seek alternatives. Only 45% of global software decision makers say they are satisfied with their existing HCM product and plan to keep it, while 53% are evaluating other products from either existing or different vendors. (see endnote 2) As a result of these trends, cloud HCM suite customers should look for vendors that:

- Innovate to match market needs and direction. Leading vendors are responsibly leveraging AI-enabled capabilities to improve HR process workflows, provide more workforce insight to leadership, and/or deliver hyperpersonalized employee experiences. They also understand the need for greater workforce adaptivity and seek to understand and apply workforce skills and improve support for contingent labor and team-based organizational structures.

- Focus on delivering the second “S” in SaaS. As the cloud HCM market has rapidly grown, some vendors have forgotten that SaaS stands for software-as-a- service . Choose vendors that provide clear commercialization and good experience scores. Look for vendors that don’t seek to charge extra for every “innovation” and include compelling postsales support capabilities that provide long-term value (not just short-term deployment support).

- Understand that the “product suite” doesn’t always win — customers do. No vendor provides mature and innovative cloud capabilities in every functional area — yet. Choose vendors that provide clear roadmaps with good partnerships and mature marketplaces to fill gaps. Further, as AI-enabled bots fuel more conversational interfaces, HCM suite users will not “click” to complete tasks. Choose vendors that understand that AI is the new UI and HR processes will melt into the flow of work and work-based applications to help customers actually improve their work and business results.

VENDOR OFFERINGS

Forrester included 11 vendors in this assessment: ADP; Ceridian; Kronos; Meta4, A Cegid Company; Oracle Cloud HCM; Ramco Systems; SAP SucessFactors; Talentia Software; Ultimate Software; Unit4; and Workday. We also invited Infor to participate in this Forrester Wave, but it chose not to participate, and we could not make enough estimates about its capabilities to include it in the assessment as a nonparticipating vendor.

VENDOR PROFILES

Our analysis uncovered the following strengths and weaknesses of individual vendors.

Leaders

- Workday offers a compelling HCM strategy for HR and finance professionals. Based in Pleasanton, California, Workday has more than 2,900 customers for its HCM suite. Payroll is supported natively for the US, Canada, the UK, and France and via partners for additional countries. Workday continues to improve its talent management capabilities with the addition of an AI/machine-learning-driven talent marketplace that supports “gigs” and projects and a new employee experience for career development. Workday introduced its Skills Cloud in 2018, marking a foundational change to Workday’s HCM solution. Utilizing AI/machine learning, Skills Cloud helps organizations create a “skills ontology” to identify the skills they have, plan for the skills they need, and use skills data to optimize their workforce.

- We expect to see Workday leverage its Skills Cloud and machine learning capabilities to improve recruiting, learning, and a new Career Hub (career recommendation capability) as well as workforce analytics and workforce planning. The Workday Assistant (its AI-enabled bot) will continue to evolve and support more use cases. Workday is a good option for large organizations (more than 5,000 employees) that seek to understand and optimize their talent by leveraging a skills-centric foundation and machine learning. Workday recently introduced Workday Credentials Management for organizations to securely request, issue, and verify worker credentials and WayTo by Workday, which leverages blockchain technology to store and manage verified user credentials on any device.

- Oracle Cloud HCM proves that long-term strategies and leadership pay off. Based in Redwood City, California, Oracle has more than 5,000 customers on Oracle Cloud HCM. Payroll is supported natively for nine countries (the US, Canada, Mexico, the UK, Saudi Arabia, Qatar, Kuwait, United Arab Emirates, and China) and via partners for additional countries. Oracle brought its Cloud HCM product to market in 2009. Following more than a decade of sustained development, which included major investments in user experience design and the acquisition of Taleo (2012), Oracle Cloud HCM now provides a comprehensive, sophisticated HCM suite. Campaigns, which is Oracle Recruiting’s candidate relationship management capability, now has good depth for designing and managing candidate campaigns. Oracle’s HR Help Desk is gaining adoption and includes guided learning and a digital assistant. Oracle also includes Advanced HCM Controls for risk management (i.e., segmentation of duties and employee privileges) and the Experience Design Studio for customers to create and configure unique rules and policies. An interesting capability called Narrative provides the literal words/copy for what workforce analytics data means and how to interpret it.

- We expect to see Oracle continue to increase the depth of functionality in recruiting, HR service delivery, and digital assistant use cases. We also expect to see pay-in-advance capabilities introduced in 2020 and an increase in go-to-market activities to support Cloud HCM. Oracle Cloud HCM is a good option for larger, multinational organizations (more than 5,000 employees) with more sophisticated HCM needs, including those using legacy Oracle on-premises solutions (e.g., PeopleSoft).

- Ultimate Software is well positioned to capitalize on its recent merger with Kronos. Based in Weston, Florida, Ultimate has more than 6,600 customers on its UltiPro HCM platform with sustained profitable growth. Payroll is supported natively for the US and Canada and via partners for other countries. Ultimate differentiates itself by focusing on the second “S” in SaaS: service. Ultimate has a convincing people-first internal culture that it extends, in real terms, to customers. For example, Ultimate starts subscription billing at go-live and provides unlimited end user training as part of its subscription price — and this does not imply an overly complex solution. To the contrary, UltiPro has advances that help simplify the experience. Predictive analytics is included in the employee profile and provides instant insight in retention risk, performance potential, and engagement (and predictive analytics is also included in the subscription price; it’s not an add-on). UltiPro’s Perception survey capabilities, powered by its Xander AI platform, can analyze unstructured data and detect the emotional state of the survey responses. Ultimate’s differentiated vision is to help organizations see beyond the employee experience and focus on people’s “lifework journeys.”

- On February 20, 2020, Ultimate Software entered into a merger agreement with Kronos, which became final on April 1. We expect to see UltiPro leverage Kronos’ Workforce Dimensions for workforce management. UltiPro supports basic time and attendance capabilities natively. It supports more complex workforce management scenarios through its partnership with Infor. UltiPro is a good fit for North American companies with distributed, global workforces and provides good versatility to support medium-large organizations (more than 500 employees).

- SAP SuccessFactors seeks to differentiate via its HXM Suite. Based in Waldorf, Germany, SAP SuccessFactors has more than 6,800 customers on its Human Experience Management (HXM) Suite. Payroll is natively supported for an impressive 46 countries. SAP SuccessFactors recently renamed its HCM suite “HXM” to reflect the focus on employee experience management tools by SAP Qualtrics, AI-based user experiences, and its formidable partner ecosystem. Integration points with Qualtrics surveys and experience management tools are starting to be applied throughout the HXM suite. SAP SuccessFactors recently introduced SAP Content Stream by Skillsoft, provided via Skillsoft’s Percipio platform. SAP Content Stream surfaces learning in the flow of work via a browser-based plug-in. SAP SuccessFactors provides comprehensive talent acquisition capabilities. SAP introduced additional rule configurations to help with high-volume recruiting. AI-assisted recruiting capabilities such as complex interview scheduling and applicant-job matching are delivered via partners such as eightfold.ai and My Ally. SAP SuccessFactors is a founding member of the Velocity Network Foundation for using blockchain to manage employee credentials.

- We expect SAP SuccessFactors to introduce AI-enabled, conversational capabilities that leverage SAP Leonardo intelligent technologies throughout the HXM Suite product. We also anticipate that FlexPay by SAP (SAP’s on-demand pay solution) will become generally available and integrated with SAP Employee Central Payroll in 2020. SAP SuccessFactors is a good fit for large, global organizations (more than 5,000 employees).

Strong Performers

- Ceridian is moving into large, global enterprises. Based in Minneapolis, Minnesota, Ceridian has more than 4,300 customers on its Dayforce HCM solution. Payroll is supported natively for six countries (the US, Canada, the UK, Ireland, Australia, and New Zealand) and via partners for additional countries. Ceridian continues to improve Dayforce’s capabilities, including Dayforce Hub (its updated UX). Managers now receive a Flight Risk Toolkit that shows not just who is at risk but recommendations for what to do to help mitigate the risk. Ceridian is applying AI in innovative ways to improve employee — and customer — experience. The Dayforce Assistant (its AI-enabled bot) helps improve employee experience, while Dayforce Activate (its RPA-enabled tool) helps improve customer implementation quality and time.

- We expect to see Ceridian continue to leverage its “continuous calculation” capabilities as well as AI-enabled processes to improve employee and customer experience. Ceridian recently launched Dayforce Wallet, which will provide employees with immediate access to earned wages with tax remittance. In 2020, we expect to see Ceridian move to general availability of Dayforce Intelligence. We also expect Ceridian to expand the list of countries supported for payroll. Ceridian Dayforce is a good option for midsized to large organizations (more than 2,000 employees) that operate in retail, hospitality, manufacturing, healthcare, financial services, or the public sector.

- Kronos provides powerful workforce management and AI-enabled capabilities. Based in Lowell, Massachusetts, Kronos has more than 4,000 customers on its Workforce Ready HCM suite. Payroll is supported natively for the US and via a partner for Australia. Payroll and other Workforce Ready capabilities may be augmented with AIMEE (AI for Managers and Employees), Kronos’ AI-engine. AIMEE is built on Google’s AI platform and available as an add-on. For example, AIMEE can be applied in payroll to analyze labor costs and proactively find errors and in workforce management scheduling to create optimum schedules and ensure compliance. Additional improvements in Workforce Ready include a redesigned, mobile-first user experience and partnerships for learning (via Docebo) and talent acquisition (Twilio for messaging). The Employee Perspectives feature provides configurable metrics that deliver an intuitive view of how an employee is doing, including traits such as reliability, potential, fatigue, and responsiveness to incentives, for example.

- On February 20, 2020, Kronos entered into a merger agreement with Ultimate Software, which became final on April 1. We expect to see Workforce Ready continue to support midmarket organizations. As such, we expect native support for Canadian payroll and other countries via more partnerships. We also expect to see an on-demand pay capability provided in 2020 (Kronos currently supports this via its partners Even, Branch, and PayActiv) and expanded use cases for AIMEE. Kronos Workforce Ready is a good fit for midsized North American companies (between 100 and 5,000 employees), especially those in financial services, the public sector, healthcare, retail, or manufacturing.

- Ramco Systems is differentiating with payroll and a “Zero UI” strategy. Based in Chennai, India, Ramco has more than 300 customers on its Global Payroll & HR suite. Payroll is supported natively for an impressive 45 countries throughout Asia Pacific, the Middle East, and Europe. Ramco’s payroll capabilities leverage machine learning for error detection. Interesting integrations with partners provide support for facial recognition and breath analysis as part of its time and attendance capabilities. Ramco’s strategy is to provide a “Zero UI” approach, which leverages more AI and workforce applications for delivering HR services and workflows. Ramco’s Outlook Actionable Messages capability incorporates HR processes, such as time and attendance, directly in the Microsoft Outlook email and calendar user experience.

- We expect to see Ramco continue to add use cases to CHIA, its AI-enabled digital assistant. We also expect Ramco to introduce support for US-based payroll in 2020 and begin leveraging responsive design for an improved user experience. Ramco is a good option for medium-large organizations (more than 2,000 employees) based in Europe, Asia Pacific, or the Middle East. The solution is also a good add-on/regional solution for large, global organizations that also operate within Ramco’s footprint and especially seek to leverage its payroll offering in these areas.

- Unit4 is reemerging with an industry-specific, people experience focus. In April 2019, Unit4 announced new leadership with Mike Ettling, former president of SAP SuccessFactors, serving as CEO. Based in Utrecht, Netherlands, Unit4 has more than 260 customers for its HCM solution, which it also provides as part of its newly formed People Experience Suite. Additional solutions in the suite include enterprise resource planning (ERP) and professional service automation. Payroll is supported natively for Australia, Canada, Norway, Sweden, the UK, and the US. Unit4 also supports payroll for Poland and across the Asia Pacific region in Singapore, Malaysia, Indonesia, Philippines, Thailand, Hong Kong, China, Macau, and Taiwan via additional tools. Especially relevant for service-based industries, Unit4’s Snapshot and Conversation capabilities provide project-based performance management, where performance feedback is collected in the flow of work (e.g., after each consulting delivery) and can include feedback from the customer.

- We expect to see Unit4 continue to simplify and align the user experiences, processes, and data of its People Experience Suite across its supporting products — Unit4 ERP/Business World, Unit4 Intuo (which it acquired last year), and Unit4 Prevero (its workforce analytics and planning solution). We also expect to see additional use cases supported by Wanda, Unit4’s AI-enabled bot, and new capabilities that help it differentiate in its four targeted industries. Unit4 is a promising option for midsized to large, global organizations (more than 2,000 employees) that operate in nonprofit, higher education, the public sector, and professional services.

- ADP Workforce Now maintains a strong presence in small to midmarket companies. ADP provides a range of payroll and HCM solutions. Based in Roseland, New Jersey, ADP is a long-standing market leader for payroll services, with $14.2 billion in revenue. ADP also provides two HCM suites: ADP Vantage, which has historically focused on large, US-based multinational firms, and ADP Workforce Now, which is focused on midmarket North American organizations. This evaluation covers Workforce Now, which natively supports payroll for the US and Canada. ADP differentiates its Workforce Now offering with self-service and mobile capabilities as well as payroll, benefits, and compliance expertise and workforce management (offered in partnership with Kronos). ADP’s StandOut, which is a continuous performance solution provided by ADP’s acquisition of the Marcus Buckingham Company, has not been integrated with Workforce Now. Workforce Now does provide integration options with ADP’s Flexible Foundations capabilities for ERP integration. Additionally, the ADP Marketplace includes more than 300 partners with tools for midsized organizations.

- ADP’s commercial model is relative complex, with multiple bundles that include different functional capabilities. In the future, we hope to see simplified commercialization and go-to-market focus (along with its broader HCM product portfolio), especially considering the introduction of ADP’s Next Gen HCM solution, which has generated significant industry interest and innovation acclaim for its team-based approach and architecture. ADP Workforce Now is an appropriate fit for North American organizations with between 500 and 5,000 employees. ADP declined to participate in the full Forrester Wave evaluation process.

Contenders

- Talentia is gaining momentum as a multinational HR and finance solution provider. Based in Paris, France, Talentia has more than 2,030 customers for its Talentia HR Suite. Payroll is supported natively for France and via partners for additional countries. Talentia HR Suite supports eight languages natively and is localized for France, Italy, Spain, Portugal, and the UK. Talentia continues to improve its core HR capabilities and now includes a Reference Date slider across the employee profile that allows users to view different employee profile elements or organizational charts at different points in time. Organizational charts support different structures (e.g., legal, job, functional, etc.) with predefined and configurable “perspectives” that support different, adaptable ways to view the entire organization, including contingent labor.

- We expect to see Talentia increase the number of countries where it provides native payroll, language support, and country-specific localizations. As part of its strategy, country-specific localizations may be delivered by its partners. We also expect to see improvements in onboarding, workforce planning, and use of AI/machine learning and conversational interfaces to improve the user experience. In 2020, Talentia aims to introduce Theo, its artificially intelligent assistant to augment and simplify the user experience. Talentia is a good option for Europe-based, midsized organizations (500 to 5,000 employees) that seek to not only leverage capabilities to support workforce operations and strategies but also receive their financial solutions from the same vendor.

- Meta4, a Cegid Company, is transforming to better serve European organizations. Based in Lyon, France, Cegid acquired Meta4 in September 2019 to expand its market and provide additional HCM capabilities that support France, Spain, Portugal, and Latin American countries. Cegid, now with Meta4, supports more than 1,300 customers, of which more than 390 are cloud customers on the Cegid PeopleNet suite. Payroll is supported natively for Argentina, Chile, Colombia, France, Mexico, Peru, Portugal, and Spain and via partners for additional countries. Cegid PeopleNet provides good core HR, workforce management, and employee performance management capabilities. With PeopleNet, users can compare “talent groups” (teams) side by side and use filters with adjustable sliders to dynamically adjust the visualization of employees within a talent matrix.

- We expect to see Cegid continue to simplify and align the user experience, processes, and data of its reimagined PeopleNet suite. We also expect to see additional integration capabilities and partnerships as part of a reinvigorated go-to-market approach. Cegid PeopleNet is a good fit for medium-large organizations that primarily focus their operations in France, Spain, Portugal, and Latin America. The solution is also a good regional solution for large, global organizations that also operate within Cegid’s footprint.

EVALUATION OVERVIEW

We evaluated vendors against 30 criteria, which we grouped into three high-level categories:

- Current offering. Each vendor’s position on the vertical axis of the Forrester Wave graphic indicates the strength of its current offering measured across nine application-oriented functional dimensions (i.e., talent acquisition, payroll, etc.), seven platform capabilities (i.e., extensibility, usability, etc.), and customer experience.

- Strategy. Placement on the horizontal axis indicates the strength of the vendors’ strategies. In this area we evaluate product strategy and roadmap as well as go-to-market strategy and execution across 10 dimensions.

- Market presence. Represented by the size of the markers on the graphic, our market presence scores reflect the analysis of three dimensions: each vendor’s company revenues, the number of customers, and the number of licensed users.

Vendor Inclusion CriteriaForrester included 11 vendors in the assessment: ADP; Ceridian; Kronos; Meta4, A Cegid Company; Oracle Cloud HCM; Ramco Systems; SAP SuccessFactors; Talentia Software; Ultimate Software; Unit4; and Workday. Each of these vendors has:

- A minimum of 200 live cloud customers. To qualify for inclusion in this Forrester Wave, each vendor needed to have at least 200 live, operational customers on its cloud HCM suite as of December 31, 2019.

- Support for an average customer size of at least 500 employees. Most participating vendors are well above this threshold and can support enterprise clients with complex requirements. However, vendors that support midmarket customers with plans to scale more into specific vertical markets and/or enterprise environments are also included.

- A comprehensive cloud HCM offering. The functional breadth of the cloud HCM offering should support an organization’s people operations and strategy. Cloud must be the primary delivery model, and payroll must be natively supported for at least one country.